我们公司主要的特色服务是:汽车电瓶,汽车配件,汽车音响等,诚信是我们立足之本,创新是我们生存之源,便捷是我们努力的方向,用户的满意是我们大的收益、用户的信赖是我们大的成果。乘风破浪会有时,直挂云帆济沧海,耐驰人相信,面对新科技革命的激烈竞争,一定会创造出更加优秀的成绩,回报家乡、回报社会、回报祖国。...

- 2024-04-28 02:51 水杯壁很多气泡能喝吗 保温杯盖里面是泡沫健康吗?如果纯净水存放时间太长了,使其水变质了,倒入,这样的水是不可以喝的,会对健康造成危害,容易造成肠胃的疾病,出现腹痛、。水杯壁很多气泡能喝吗-业百科如果是加工过程中材质不均匀 ...

- 2024-04-28 02:30 昏睡红茶是什么梗 为什么说迪亚波罗是章鱼?1.迪亚波罗的替身叫做“绯红之王”,这个名字里有“王”这个字,是王道征途;先辈也表示自己喜欢王道征途。2.迪亚波罗想要雷普多比欧,(确信)是屑;先辈想要...1...有哪些好的 ...

- 2024-04-28 02:12 今天是你的生日歌曲原唱 前言:答:韦唯,是谷建芬为韦唯定做的通俗歌曲。答:郑智化,生日快乐答:《今天是你的生日,中国》这首歌曲的原唱者是董文华,歌词如下:《今天是你的生日,中国》原唱:董文华;填词:韩静霆;谱曲:谷建芬今天是 ...

- 2024-04-28 01:33 成熟了的西梅是什么颜色的 西梅红色和紫色哪个好?西梅有紫色和红色则是因为其品种多样,会出现紫红色、深紫色、金色等多种颜色,一般成熟的普通西梅是呈现深紫色、紫红色的,而如红西梅、大玫瑰晚黑、耶鲁尔、。成熟了的西梅是什么颜色的-业 ...

- 2024-04-28 01:29 8个人的队形 前言:8个人舞蹈队形怎么排1、第一种方案,如下图所示,成一字型排开。2、第二种方案,如下图所示,成两行排列。3、第三种方案,如下图所示,三行排列。4、第四种方案,如下图所示,领舞的在最前方。5、第五种 ...

- 2024-04-28 01:22 横店炮王霍建华什么梗 叶璇霍建华为什么分手?[精]2014年6月,有自称“横店影视城演员”爆料,指叶璇正牌男友其实是霍建华,两人秘恋不到1个月,还说霍是因不满和叶璇“女尊男卑”关系才分手。而不管是什么原因,现当事人。霍建华 ...

佛山市某某人力咨询客服中心

地 址:联系地址联系地址联系地址

电 话:020-123456789

网址:www.rutuonline.com

邮 箱:admin@aa.com

GS杰士统一蓄电池46B24LS适配锋范1.8雅阁2.0颐达NV200汽车电瓶

别克昂科旗仪表台避光垫汽车内饰装饰用品配件中控台改装防晒垫

骆驼蓄电池57069适配迈腾速腾新帕萨特君威途观汽车电瓶 以旧换新

适配五菱之光6371 6376 6400发电机皮带 空调4PK760 850汽车配件

专用于15-21款新楼兰汽车20保险杠前后护杠改装配件护板防护防撞

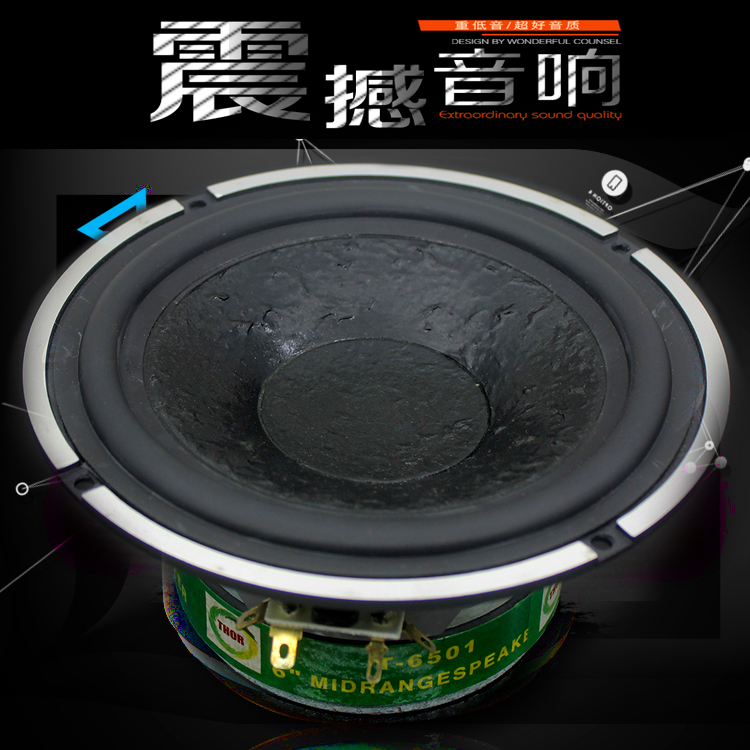

汽车载音响进口发烧升级纯丝膜小高音头球形仔改装喇叭扬声器一对

风帆蓄电池6-QW-36/36B20L-H适用飞度锋范思迪奥拓理念汽车电瓶

骆驼蓄电池78550适配别克GL8赛威凯迪拉克60ah汽车电瓶 以旧换新

2021款rav4荣放威兰达尾门板饰条后杠护板贴片后备箱亮条配件改装

专用 凯迪拉克XT6后备箱网储物网兜固定行李车载收纳尾箱改装配件

征服者MONKEY小猴子汽车贴纸 个性车身贴 搞笑车贴创意汽车贴纸

瑞典DLS汽车音响改装6.5寸套装喇叭进口发烧炸街低音喇叭功放主推

适配三菱猎豹V31V33黑金刚2030奇兵Q6汽车 顶胎器 尾门备胎顶配件

美式转欧式转换头房车尾灯信号插座欧规7针13针美规7互转改装配件

瓦尔塔蓄电池58043适配宝马3系5系奔驰C级E级沃尔沃汽车电瓶 银标

CNG天然气汽车OMVL可替换喷轨伊兰特雪铁龙东风吉利改装配件包邮

汽车音响4寸5寸6寸6.5寸6*9同轴全频高中重低音车载改装喇叭套装

专用于保时捷新卡宴保时捷macan改装内饰储物汽车用品配件置物盒

汽车装饰贴纸 车贴搞笑 卡通可爱划痕车门贴 亲嘴小破孩个性创意

通用兄弟连改装车贴越野车SUV车身贴纸汽车拉花全车装饰贴花划痕